Bitcoin ETF Reserve Dominance: BlackRock, Grayscale, and Fidelity

Dec 25, 2024The landscape of Bitcoin ETF reserve dominance is shifting, with BlackRock and Fidelity gaining ground against Grayscale. This article explores the competition and its impact on Bitcoin's price.

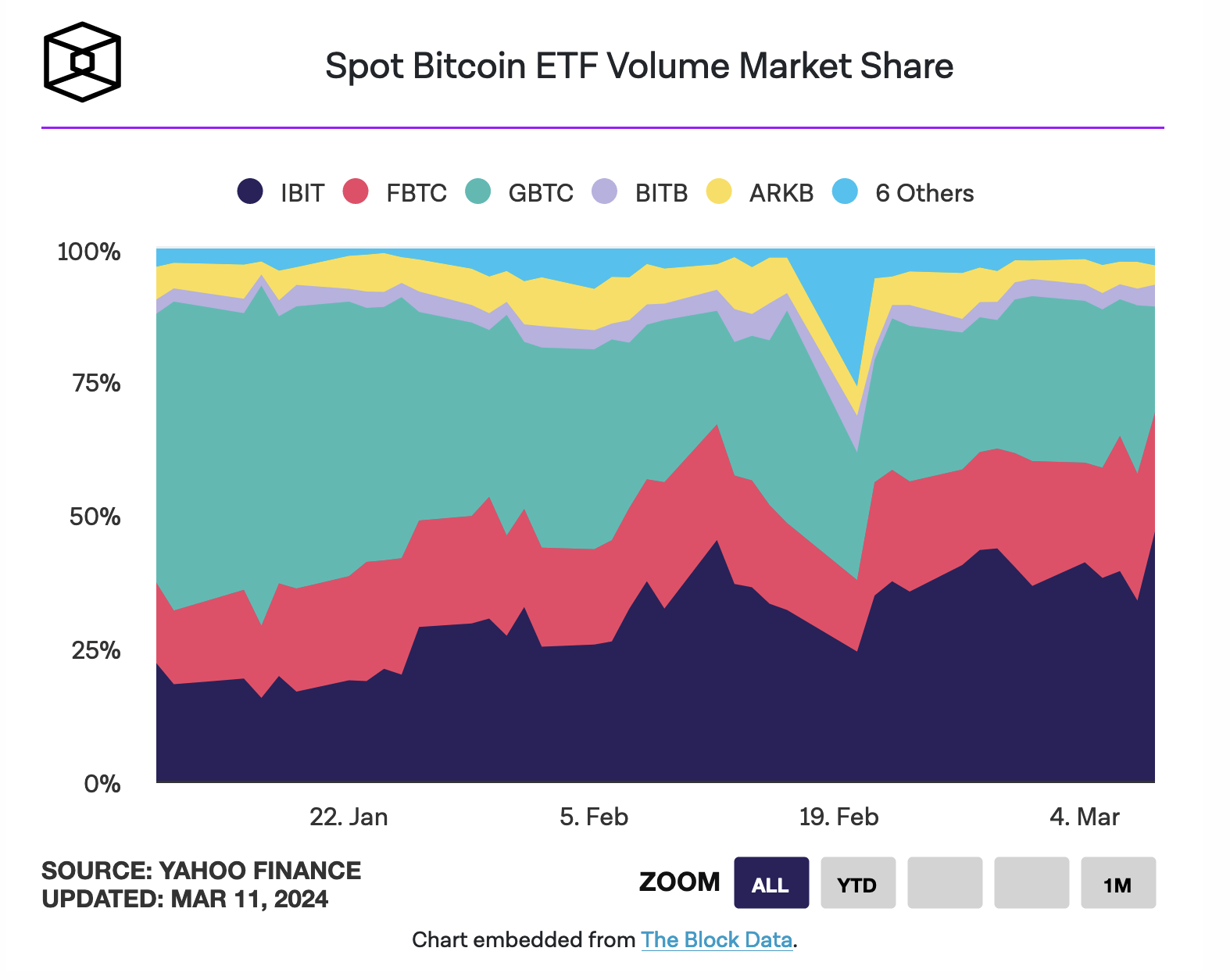

The landscape of Bitcoin ETF reserve dominance by Blackrock, Grayscale, and Fidelity is rapidly shifting, with these three firms emerging as major players in the burgeoning market. While Grayscale initially held a commanding lead, BlackRock and Fidelity have aggressively gained ground, reshaping the distribution of Bitcoin holdings among these exchange-traded funds. This article explores the dynamics of this evolving competition, analyzing the factors contributing to the changing market share and the potential implications for Bitcoin's future price.

The Rise of BlackRock and Fidelity in the Bitcoin ETF Arena

BlackRock and Fidelity have quickly become dominant forces in the spot Bitcoin ETF market, attracting billions of dollars in investments since their launch. BlackRock's IBIT and Fidelity's FBTC have seen significant inflows, rapidly accumulating Bitcoin and challenging the established dominance of Grayscale's GBTC. This surge in popularity can be attributed to a combination of lower fees and the established reputation of these traditional financial giants.

Credit: dlnews.com

The combined holdings of BlackRock and Fidelity now represent a significant portion of the total Bitcoin supply, with over 100,000 Bitcoin held on behalf of investors. This rapid accumulation of Bitcoin by these two firms underscores their growing influence on the market. This increasing Bitcoin ETF reserve dominance by Blackrock, Grayscale, and Fidelity, is a key trend to watch.

Grayscale's Market Share Decline

Grayscale, while still a major holder of Bitcoin, has experienced substantial outflows from its GBTC fund. This outflow is largely due to investors seeking lower fees and taking profits after GBTC's conversion to an ETF. The higher management fee charged by Grayscale, at 1.5%, compared to the much lower fees offered by BlackRock and Fidelity, is a significant factor in this shift. Additionally, the fact that Fidelity is offering a zero-fee structure until August has further intensified the competitive landscape.

Credit: ambcrypto.com

The result is a significant decrease in Grayscale’s market share, which has dropped to below 20%, a new low since the introduction of competing products. The assets of ETFs excluding Grayscale have now surpassed GBTC’s assets for the first time, highlighting the significant shift in Bitcoin ETF reserve dominance by Blackrock, Grayscale, and Fidelity.

Competitive Dynamics and Fee Wars

The competition among these ETF providers is not just about attracting existing Bitcoin holders; it's also about attracting new investors into the market. As firms like Invesco and Galaxy slash their fees to gain a larger share, the overall cost of investing in Bitcoin through ETFs is decreasing. This could lead to increased demand for Bitcoin and potentially drive up its price. The battle for Bitcoin ETF reserve dominance by Blackrock, Grayscale, and Fidelity is also resulting in lower fees for investors.

Credit: bitbo.io

The difference in fees is a significant factor in the market share shift. BlackRock charges 0.12% for assets under $5 billion and 0.25% afterward, while Fidelity is currently waiving fees until August. This aggressive pricing strategy is attracting investors away from Grayscale’s higher-fee structure, which has further intensified the competition for Bitcoin ETF reserve dominance by Blackrock, Grayscale, and Fidelity.

Impact on Bitcoin Price and Market

The influx of institutional capital into Bitcoin through these ETFs has implications for the cryptocurrency's price. As more Bitcoin is locked up in these ETFs, the supply available on exchanges may decrease, potentially leading to price appreciation. The ETF market also provides a more accessible way for traditional investors to gain exposure to Bitcoin, which could further drive up demand.

The recent stabilization of Bitcoin's price and the slowing of Grayscale's outflows could indicate a potential uptrend. Technical indicators also suggest that a Bitcoin rally might be on the horizon, driven by increasing ETF demand and decreasing selling pressure. The ongoing battle for Bitcoin ETF reserve dominance by Blackrock, Grayscale, and Fidelity is a key factor influencing this price dynamic.

Future Outlook for Bitcoin ETFs

The long-term implications of this ETF competition are yet to be fully realized. The continued growth of BlackRock and Fidelity's ETF holdings, coupled with potential price appreciation, could further solidify their position as major players in the Bitcoin market. The level of Bitcoin ETF reserve dominance by Blackrock, Grayscale, and Fidelity will continue to be a crucial factor in the cryptocurrency’s price and stability. This competition is also expected to drive further innovation and potentially lead to the introduction of new crypto-related investment products.

The market will also be closely watching how Grayscale responds to the increasing competition. While they have made attempts to address their high fees, the battle for market share is likely to continue for the foreseeable future. The future of Bitcoin ETF reserve dominance by Blackrock, Grayscale, and Fidelity will depend on their ability to adapt to the changing market conditions.

SEC Accounting Bulletins on Digital Assets: SAB 121 and SAB 122

Explore the complexities of SEC's Staff Accounting Bulletins 121 and 122, their impact on crypto custody, and the pushback from the financial industry and Congress. Learn about the ongoing debate on digital asset regulation.

Published Jan 23, 2025

Understanding the Collectibles Landscape: Baseball Cards, Stamp Paper, and the Rise of Trump Coin

Explore the world of collectibles, from baseball cards and stamp paper to the digital Trump Coin. Compare market dynamics, investment potential, and unique characteristics.

Published Jan 23, 2025

The Potential for a USA Digital Asset Stockpile: Exploring the Future of Cryptocurrency Reserves

Explore the potential of a USA digital asset stockpile, examining Trump's evolving stance, legislative initiatives, benefits, challenges, and the role of a crypto working group.

Published Jan 23, 2025