Bitcoin Profit-Taking Details: Analysis of Market Dynamics and Strategies

Jan 5, 2025Explore Bitcoin profit-taking dynamics, including long-term holder behavior, on-chain metrics like SOPR, and strategies for taking and reinvesting profits.

The recent fluctuations in Bitcoin's price have sparked considerable interest in understanding the dynamics of Bitcoin profit-taking details. After reaching highs near $100,000, Bitcoin experienced a pullback, prompting analysis of factors influencing these market movements. This article synthesizes information from various sources to provide a comprehensive look at the recent Bitcoin profit-taking details, including the role of long-term holders, funding rates, and on-chain metrics.

The Impact of Profit-Taking on Bitcoin's Price

Bitcoin's journey to and around the $100,000 mark has been marked by significant volatility, driven in part by profit-taking activities. A recent correction saw Bitcoin’s price slump by 14% in a week, with long-term holders (LTHs) playing a key role in this downturn. Bitfinex Alpha reports that this correction led to over $1.1 billion in liquidations across both long and short positions on major centralized exchanges. The speed of the price drop, with 10% of the fall occurring within eight minutes, highlights the intense selling pressure that can quickly impact the market.

Credit: www.tradingview.com

Long-Term Holders and Market Dynamics

While Bitcoin's medium-term outlook remains bullish, long-term holders have been selling their assets, albeit at a slower pace. This selling activity is a key component of Bitcoin profit-taking details, as it represents the actions of investors who have held the cryptocurrency for extended periods and are now choosing to realize their gains. The pace of LTH distribution has slowed down, which introduces an element of uncertainty into the market trajectory. However, the stabilization of funding rates and low realized profit levels suggest that the market is attempting to find a new equilibrium.

On-Chain Indicators and Profit-Taking Analysis

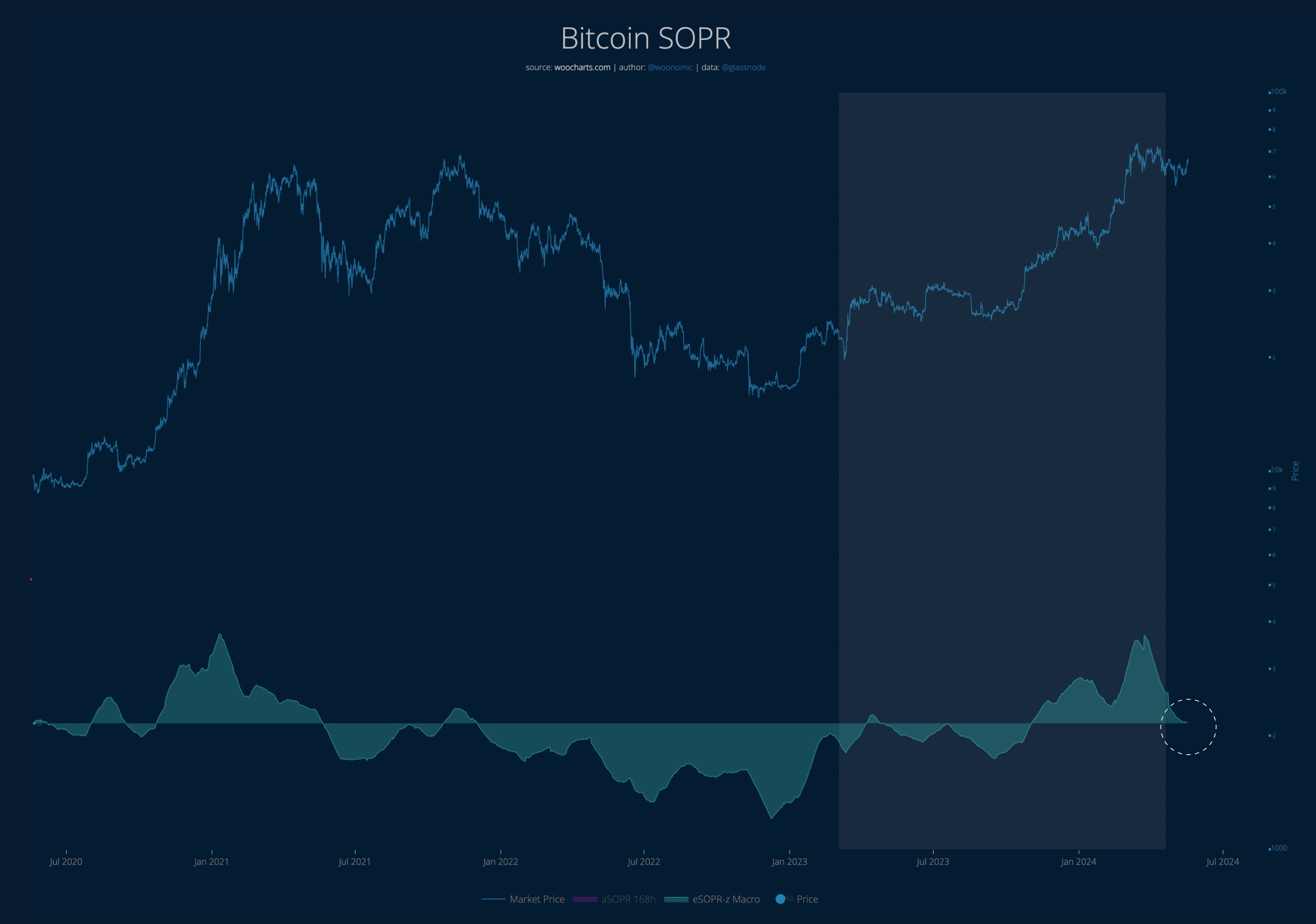

Several on-chain indicators provide valuable insights into the Bitcoin profit-taking details. One key metric is the Spent Output Profit Ratio (SOPR), which measures whether Bitcoin investors are selling their coins at a profit or loss. A SOPR value above 1 indicates that, on average, holders are selling at a profit, while a value below 1 suggests loss realization.

The Bitcoin SOPR previously spiked to highly positive levels during the cryptocurrency’s rally toward its all-time high, indicating aggressive profit-taking. However, with the subsequent consolidation, the SOPR has cooled off and approached the neutral mark, suggesting that the appetite for harvesting gains might be diminishing. As Willy Woo notes, this "healthy reset" is occurring alongside renewed capital inflows into the coin, indicating a potential shift in market sentiment.

Realized Profit and Funding Rates

The reduction in realized profit is another important aspect of Bitcoin profit-taking details. Glassnode data indicates that Bitcoin's realized profits dropped from $10.58 million to $1.58 million, signaling reduced selling pressure and a potential for price growth. This drop in realized profit suggests that fewer investors are actively selling at a profit, which can create a more stable market environment.

Funding rates, the cost of holding a perpetual futures contract, also play a role. These rates surged during Bitcoin's rise to $100,000 but have since stabilized. Declining funding rates suggest that traders are unwinding excessive long leverage, leading to a more balanced market. Conversely, rising rates might indicate renewed speculative demand and increased risk.

Strategies for Taking and Reinvesting Profits

Understanding when to take profits is essential for any Bitcoin investor. While the market's volatility makes it difficult to pinpoint the exact right time, several strategies can be employed:

- Incremental Profit-Taking: Selling portions of your holdings as the price increases allows you to secure gains while still participating in potential further growth.

- Align with Financial Goals: Determine a profit percentage based on your risk tolerance and financial situation. Benchmarks such as the S&P 500's historical annual return can help guide these decisions.

- Risk Management: Utilize stop-loss and take-profit orders to manage volatility and protect your investments.

- Historical Data: Recognize that Bitcoin often experiences rapid growth followed by corrections, and take profits during bull runs to safeguard against potential downturns.

Once profits are taken, several reinvestment options are available:

- Reinvest in New Coins: Allocate a portion of your profits to high-risk, high-reward coins or initial coin offerings (ICOs) for potentially significant returns.

- Invest in Mining: Use profits to invest in Bitcoin mining equipment, creating another potential revenue stream.

- Rental Properties or Dividend Stocks: Diversify into more stable assets like rental properties or dividend-paying stocks to generate passive income.

- Cold Storage: Safeguard a portion of your earnings in a cold storage wallet to protect your capital.

The Long-Term View and Bitcoin's Future

While short-term Bitcoin profit-taking details are influenced by market sentiment and trading activities, the long-term outlook remains optimistic. Bitcoin's limited supply and increasing adoption suggest potential for long-term growth. As one analyst noted, the best way to profit from Bitcoin is simply to buy and hold, rather than actively trying to time the market. Viewing Bitcoin as a savings vehicle, rather than a short-term investment, can lead to greater long-term purchasing power due to its limited supply and increasing adoption.

In conclusion, the recent cooling of Bitcoin profit-taking details around the $100,000 mark, alongside a decrease in realized profits and increasing holding times, suggests a potential stabilization and possible upward movement. However, investors should remain vigilant and continue to monitor market trends and on-chain metrics to make informed decisions about when to take profits and how to reinvest them wisely.

SEC Accounting Bulletins on Digital Assets: SAB 121 and SAB 122

Explore the complexities of SEC's Staff Accounting Bulletins 121 and 122, their impact on crypto custody, and the pushback from the financial industry and Congress. Learn about the ongoing debate on digital asset regulation.

Published Jan 23, 2025

Understanding the Collectibles Landscape: Baseball Cards, Stamp Paper, and the Rise of Trump Coin

Explore the world of collectibles, from baseball cards and stamp paper to the digital Trump Coin. Compare market dynamics, investment potential, and unique characteristics.

Published Jan 23, 2025

The Potential for a USA Digital Asset Stockpile: Exploring the Future of Cryptocurrency Reserves

Explore the potential of a USA digital asset stockpile, examining Trump's evolving stance, legislative initiatives, benefits, challenges, and the role of a crypto working group.

Published Jan 23, 2025