Bitcoin Short-Term Holders Profitability Analysis

Jan 7, 2025Analysis of Bitcoin short-term holders profitability, market sentiment, and strategies for navigating volatility. Key metrics and potential market implications are discussed.

The cryptocurrency market is known for its volatility, and Bitcoin short-term holders profitability is often a key indicator of market sentiment. Recent data reveals a complex picture for these investors, who are generally defined as those holding Bitcoin for less than 155 days. This article synthesizes insights from various sources to provide a comprehensive view of the current challenges and opportunities facing short-term Bitcoin holders.

Understanding Short-Term Bitcoin Holders

Short-term holders (STHs) play a crucial role in Bitcoin's market dynamics. These are typically traders and retail investors who are more likely to react to short-term price fluctuations. Their behavior can significantly influence demand and market sentiment, and their Bitcoin short-term holders profitability is a key metric to watch. Statistically, the longer an investor holds their coins, the less likely they are to sell, making STHs more prone to liquidating their holdings at the sight of profit or loss.

Defining Short-Term Holders

Short-term holders are generally considered those who have held their Bitcoin for less than 155 days. This group often includes new entrants, active traders, and those with less conviction in the long-term potential of Bitcoin. As such, they are more sensitive to market volatility and price changes.

Credit: cryptoslate.com

Credit: cryptoslate.com

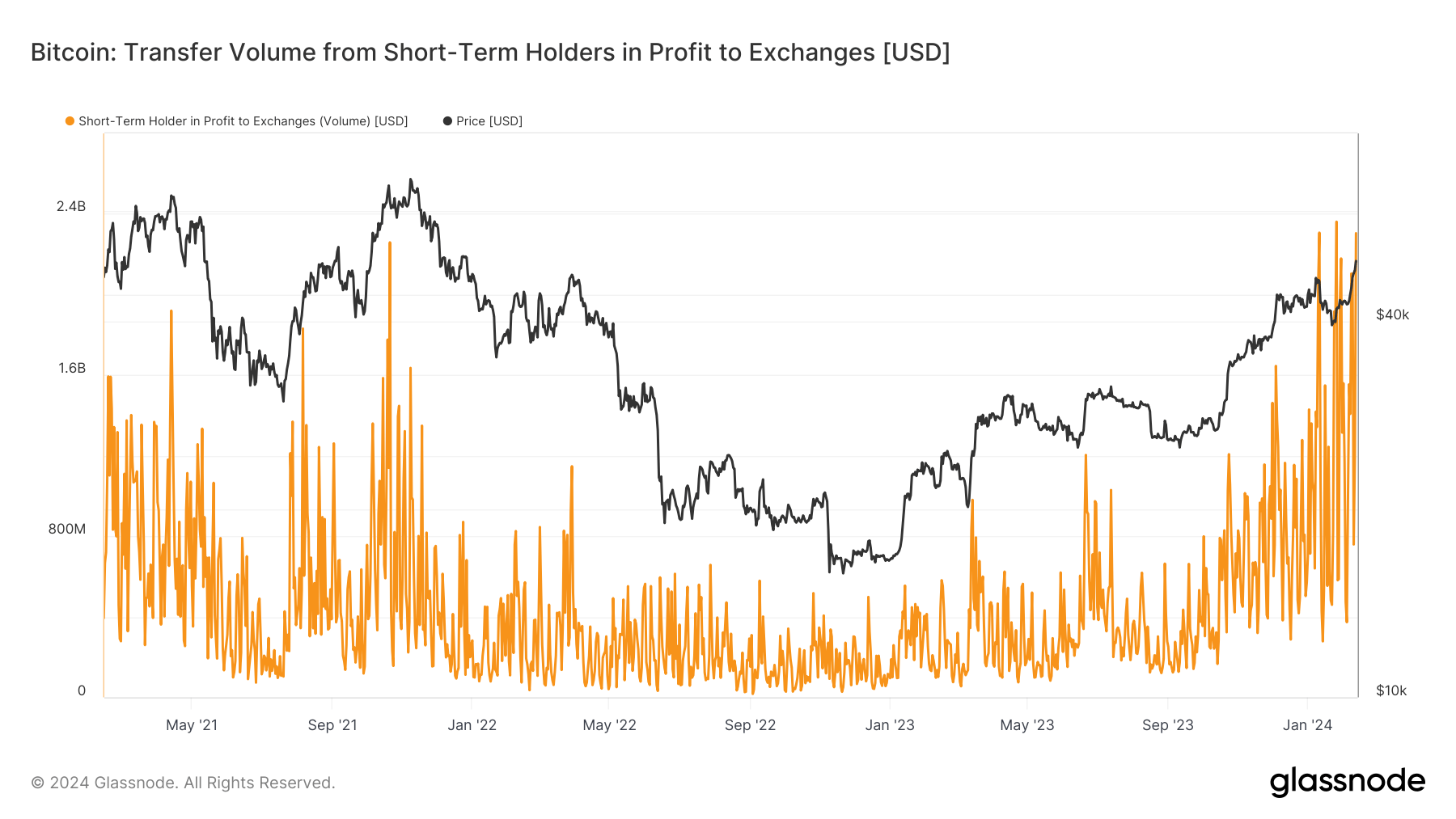

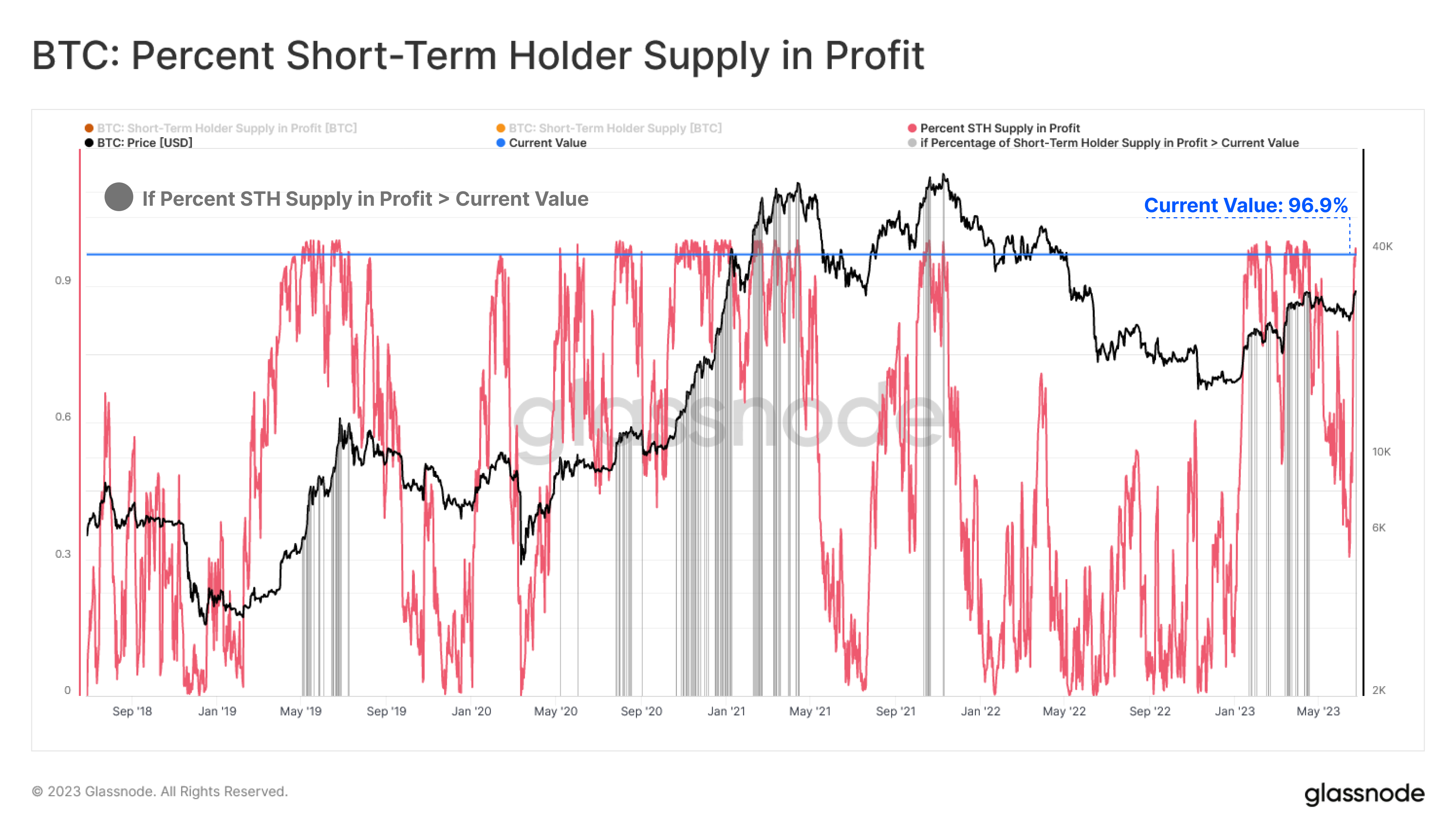

The Significance of Short-Term Holder Profitability

The profitability of STHs is a barometer for short-term demand and market sentiment. When a large percentage of STHs are in profit, it can indicate a potential market top, as these investors are more likely to take profits. Conversely, when many STHs are at a loss, it can signal a potential bottom, as weak hands capitulate and sell off their holdings. The Bitcoin short-term holders profitability metric provides insights into the strength and direction of the market.

Current Profitability Challenges for Short-Term Holders

Recent price movements in Bitcoin have created a challenging environment for short-term holders. Following significant price swings, many STHs now find themselves holding Bitcoin at or near a loss. This situation contrasts sharply with periods of bullish momentum when STHs were realizing substantial profits.

Declining Profitability Metrics

Data from various analytics firms show a decline in Bitcoin short-term holders profitability. The Market Value to Realized Value (MVRV) ratio, a key indicator for assessing the profitability of holders, has fallen below 1.0 for many STHs, indicating that they are, on average, holding at a loss. This is a notable shift from times when STHs were realizing profits as high as 55.6 times their losses, suggesting a substantial change in market conditions.

The Impact of Price Volatility

Bitcoin’s price has been highly volatile, characterized by rapid surges and declines. This volatility makes it difficult for STHs to consistently realize profits. For example, after a rally to around $108,000, a subsequent decline led to a sharp decrease in Bitcoin short-term holders profitability, causing many to hold at a loss. This volatility highlights the risks associated with short-term trading strategies.

Market Implications and Potential Scenarios

The challenges faced by short-term Bitcoin holders have broader implications for the overall market. Their actions can amplify price movements, leading to potential corrections or consolidation periods. Understanding these dynamics is crucial for all investors, not just short-term traders.

Weakened Demand and Potential Corrections

The decline in Bitcoin short-term holders profitability suggests reduced buying interest, potentially leading to lower market liquidity and increased selling pressure. Historically, similar declines have preceded market corrections, as bearish sentiment gains momentum. This indicates that the market may enter a consolidation phase, allowing prices to stabilize before a potential uptrend.

The Role of Long-Term Holders

While short-term holders grapple with losses, long-term holders (LTHs) tend to be less reactive to short-term fluctuations. They are often viewed as the “diamond hands” of the market, with a strong conviction in Bitcoin’s long-term value. During periods of market downturn, LTHs may continue to accumulate, potentially setting the stage for future price recovery. The contrast between the actions of STHs and LTHs provides a broader perspective on market dynamics.

Strategies and Recommendations for Investors

Given the current market landscape, investors, especially short-term holders, need to adopt prudent strategies to navigate the volatility and mitigate potential losses.

Risk Management

Investors are advised to reduce their risk exposure, especially when Bitcoin short-term holders profitability is trending downwards. This may involve minimizing high-risk financial decisions, diversifying portfolios, and setting stop-loss orders to limit potential losses.

Monitoring Key Indicators

It's crucial to monitor key indicators such as the Short-Term Holder Spent Output Profit Ratio (STH SOPR) and Bitcoin’s trading volume and liquidity levels. These metrics can provide insights into market sentiment and potential price movements. The MVRV ratio, as previously discussed, is another vital tool for assessing profitability and risk.

Long-Term Perspective

While short-term trading can offer opportunities for quick profits, a long-term perspective is often essential for weathering market volatility. Investors should consider the long-term potential of Bitcoin and avoid making impulsive decisions based on short-term market fluctuations.

Conclusion

The current landscape for short-term Bitcoin holders is challenging, with many facing unrealized losses due to recent price volatility. Monitoring Bitcoin short-term holders profitability is vital for understanding market dynamics and potential future price movements. While the market is currently uncertain, adopting prudent risk management strategies and maintaining a long-term perspective can help investors navigate the inherent risks and opportunities in the cryptocurrency market.

SEC Accounting Bulletins on Digital Assets: SAB 121 and SAB 122

Explore the complexities of SEC's Staff Accounting Bulletins 121 and 122, their impact on crypto custody, and the pushback from the financial industry and Congress. Learn about the ongoing debate on digital asset regulation.

Published Jan 23, 2025

Understanding the Collectibles Landscape: Baseball Cards, Stamp Paper, and the Rise of Trump Coin

Explore the world of collectibles, from baseball cards and stamp paper to the digital Trump Coin. Compare market dynamics, investment potential, and unique characteristics.

Published Jan 23, 2025

The Potential for a USA Digital Asset Stockpile: Exploring the Future of Cryptocurrency Reserves

Explore the potential of a USA digital asset stockpile, examining Trump's evolving stance, legislative initiatives, benefits, challenges, and the role of a crypto working group.

Published Jan 23, 2025