Crypto Price Plunge: Unveiling Hidden Threats and Market Instability

Jan 3, 2025Explore the hidden threats behind the recent crypto price plunge, including regulatory uncertainty, quantum computing risks, and cyber attacks. Learn how to navigate this volatile market.

The cryptocurrency market has experienced significant volatility, with crypto price plunge hidden threat becoming a major concern for investors. Recent downturns in the values of major cryptocurrencies like XRP, Ethereum, and Solana have sparked questions about the underlying causes. While market fluctuations are common, a combination of factors, including regulatory uncertainty, economic pressures, and emerging technological threats, are contributing to the current instability. This article delves into these issues, providing a comprehensive overview of the challenges facing the crypto market.

The Impact of Market Conditions and Regulatory Uncertainty

The current crypto price plunge hidden threat is partly fueled by broader economic concerns. Rising inflation, coupled with the Federal Reserve's decision to raise interest rates, has led many investors to pull back from risky assets, including cryptocurrencies. This shift has resulted in a significant sell-off, with the total crypto market value dropping dramatically.

Credit: nypost.com

Credit: nypost.com

The lack of clear regulatory oversight also contributes to market instability. Governments worldwide are grappling with how to regulate cryptocurrencies, and this uncertainty creates an environment where scams and wild price fluctuations can occur. President Biden's administration is reportedly preparing regulatory legislation for the largely unmonitored crypto markets, further adding to the uncertainty. Similarly, proposals to ban cryptocurrency mining in certain regions, like Russia, have also contributed to the negative sentiment.

The Role of Crypto Exchanges as Gatekeepers

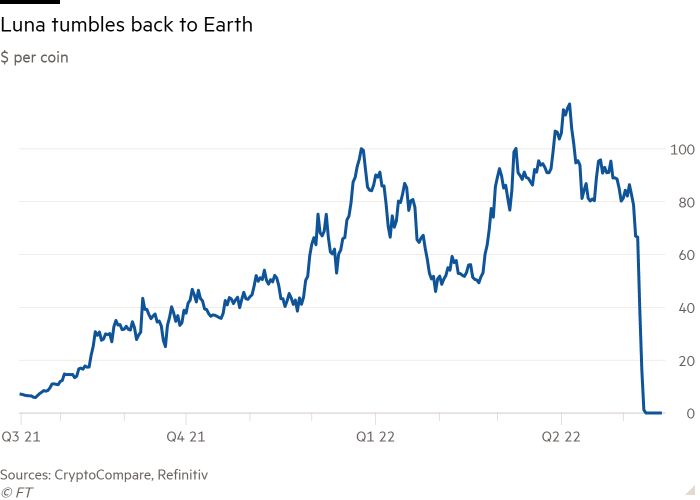

Crypto exchanges play a crucial role in determining which digital assets are accessible to mainstream traders. The collapse of Luna highlighted the importance of the standards exchanges apply when deciding to list a coin. Unlike stock markets, crypto exchanges operate with little to no regulatory oversight, making their decisions particularly impactful.

Credit: ft.com

Credit: ft.com

The pressure to list more assets, driven by trader enthusiasm, can lead to exchanges listing coins with questionable value. Some analysts believe that only a small number of crypto coins have real value, yet most exchanges list hundreds of assets. This highlights the potential for investors to be exposed to high-risk tokens. While major exchanges claim to vet tokens before listing, the sheer number of assets makes thorough scrutiny challenging. The "Coinbase effect," where new listings often see a spike in price due to increased accessibility, also contributes to market volatility.

The Emerging Threat of Quantum Computing

A significant, yet often overlooked, crypto price plunge hidden threat is the advancement of quantum computing. The cryptographic techniques that secure blockchain transactions rely on problems that are difficult for classical computers to solve. However, quantum computers, with their vastly superior processing power, could potentially break these encryptions.

Credit: bitperfect.pe

Credit: bitperfect.pe

While some consider this threat to be years, or even decades away, the rapid progress in quantum computing requires proactive measures. The cryptocurrency community is exploring quantum-resistant algorithms and other protective technologies to defend against future breakthroughs in computing power. Investors need to be aware of this potential risk when considering long-term cryptocurrency investments, as quantum computing could undermine the security and functionality of digital assets.

Specific Cryptocurrency Declines and Market Reactions

Bitcoin, the leading cryptocurrency, has seen its value plummet significantly, falling below the 50-day moving average and dropping to its lowest level in nearly six months. Ethereum and other major altcoins like Solana have followed suit, with significant percentage drops. This widespread decline has led to increased volatility and selling pressure across the market.

Credit: ft.com

Credit: ft.com

The recent downturn has also affected crypto-related stocks. Crypto miners and exchange sites have experienced substantial share price declines, reflecting the broader market anxiety. Some investors are now being advised to pursue direct digital assets instead of ETFs and crypto-related stocks. However, there are also warnings against entering the crypto market without understanding its high-risk nature. The market's sensitivity to sociopolitical events and economic indicators further underscores the volatility of crypto investments.

Hidden Risk Campaigns and Cyber Threats

Beyond market fluctuations and technological concerns, malicious campaigns also pose a threat to cryptocurrency users. The "Hidden Risk" campaign, which uses fake crypto news to distribute malware, highlights the vulnerability of the crypto community to cyber attacks. Phishing attempts targeting crypto-related businesses and individuals can lead to the download of malware, compromising user security and potentially causing financial losses.

The use of fake news and social engineering tactics to trick victims into downloading malicious software demonstrates the persistent risk of cyber threats in the crypto space. Such threats can exacerbate existing market instability and erode investor confidence. Therefore, it's important for crypto users to remain vigilant and aware of the potential risks from cyber attacks.

Strategies for Navigating the Volatile Crypto Market

While the recent crypto price plunge hidden threat is concerning, investors can take steps to navigate the volatile market. Diversifying investments, avoiding highly speculative assets, and staying informed about technological developments and regulatory changes are essential. It is also crucial to only invest what one can afford to lose, as cryptocurrency remains a high-risk investment. Some investors are choosing to hold on to their cryptocurrency in the hopes of a future rebound, while others are reevaluating their positions and considering safer investment options. It's also advisable to stay up to date on the latest cyber security threats and best practices for protecting digital assets.

Conclusion

The recent crypto price plunge hidden threat is a complex issue driven by a combination of economic pressures, regulatory uncertainty, emerging technological threats, and cyber security risks. While the future of the crypto market remains uncertain, investors can navigate these challenges by remaining informed, cautious, and strategic in their approach. Understanding the various factors contributing to market volatility, including the role of exchanges, the potential impact of quantum computing, and the persistent threat of cyber attacks is crucial for making informed investment decisions.

SEC Accounting Bulletins on Digital Assets: SAB 121 and SAB 122

Explore the complexities of SEC's Staff Accounting Bulletins 121 and 122, their impact on crypto custody, and the pushback from the financial industry and Congress. Learn about the ongoing debate on digital asset regulation.

Published Jan 23, 2025

Understanding the Collectibles Landscape: Baseball Cards, Stamp Paper, and the Rise of Trump Coin

Explore the world of collectibles, from baseball cards and stamp paper to the digital Trump Coin. Compare market dynamics, investment potential, and unique characteristics.

Published Jan 23, 2025

The Potential for a USA Digital Asset Stockpile: Exploring the Future of Cryptocurrency Reserves

Explore the potential of a USA digital asset stockpile, examining Trump's evolving stance, legislative initiatives, benefits, challenges, and the role of a crypto working group.

Published Jan 23, 2025