Senator Calls for Strategic Bitcoin Reserve to Bolster U.S. Financial Innovation

Jan 23, 2025Explore the growing movement for nations to adopt Bitcoin as a strategic reserve, with insights from Senator Lummis's proposal and global perspectives on Bitcoin's potential as 'digital gold'.

Senator Calls for Strategic Bitcoin Reserve to Bolster U.S. Financial Innovation

The landscape of national financial strategies is undergoing a significant shift, with discussions around Bitcoin's role in national reserves gaining traction. On January 23, 2025, the concept of a Senator calls for Bitcoin reserve to enhance economic stability and independence is no longer a fringe idea but a topic of serious consideration in governments worldwide. This article examines the emergence of Bitcoin as a strategic asset, the arguments for and against its adoption, and the potential implications for the global monetary order.

The Push for a U.S. Bitcoin Reserve

The idea of a strategic Bitcoin reserve has been gaining momentum, particularly in the United States. Senator Cynthia Lummis of Wyoming, a staunch advocate for cryptocurrency, has been instrumental in pushing for the creation of a U.S. Bitcoin reserve.

- The BITCOIN Act: Lummis introduced the BITCOIN Act, which proposes the U.S. government purchase one million Bitcoin over five years. The goal is to "supercharge the U.S. dollar" and reduce the national debt.

- Political Support: The idea has found support from figures like former President Donald Trump, who expressed a commitment to maintaining any Bitcoin the government acquires. Robert F. Kennedy Jr. also supported the idea of a strategic reserve, suggesting a figure closer to the country's gold reserves.

Senator Lummis's Vision and the Trump Administration

Senator Lummis has been at the forefront of advocating for Bitcoin within the U.S. financial system. Her efforts have gained traction, especially with the incoming Trump administration showing openness to the idea.

- Selling Gold for Bitcoin: Lummis has even proposed selling some of the Federal Reserve’s gold to fund the purchase of Bitcoin for the strategic reserve, aiming to avoid increasing the government deficit.

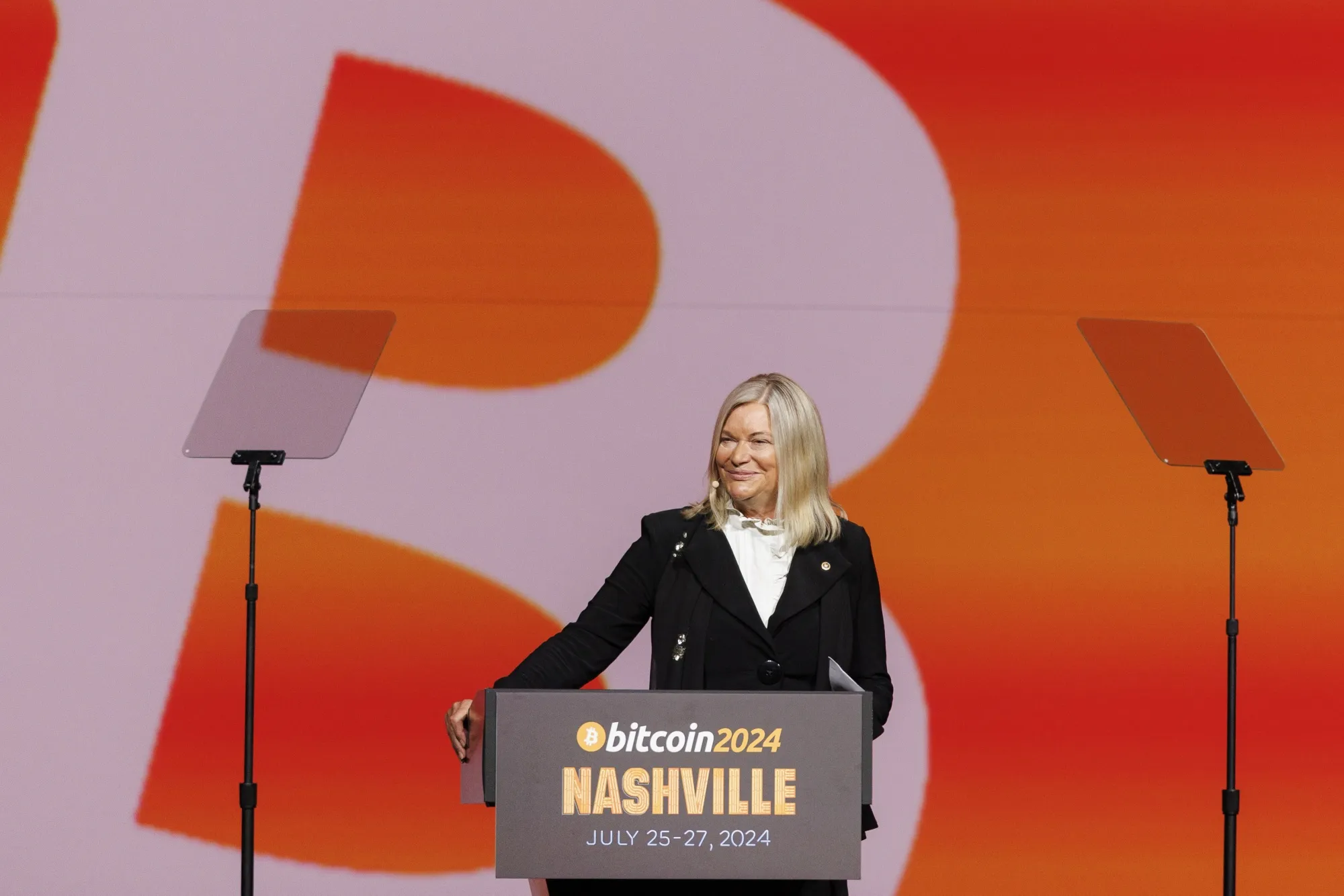

Senator Cynthia Lummis, a Republican from Wyoming, speaks at the Bitcoin 2024 conference in Nashville in July. Credit: bloomberg.com

Senator Cynthia Lummis, a Republican from Wyoming, speaks at the Bitcoin 2024 conference in Nashville in July. Credit: bloomberg.com - Feasibility: Lummis expressed confidence that a strategic Bitcoin reserve could be established quickly under the Trump administration, potentially within the first 100 days.

Arguments Against a U.S. Bitcoin Reserve

Despite the support, the idea of a government-backed Bitcoin reserve faces considerable skepticism and criticism.

- Volatility Concerns: Experts caution against investing heavily in a volatile asset like Bitcoin, as its price can fluctuate dramatically due to market sentiment, regulatory changes, and broader economic trends. Alisha Chhangani from the Atlantic Council’s GeoEconomics Center warns that Bitcoin's volatility could pose a significant liability for the U.S. government.

- Speculative Nature: Critics argue that a Bitcoin reserve would essentially position the government as a speculator in a highly volatile asset class, unlike the Strategic Petroleum Reserve, which aims to stabilize oil prices during supply disruptions.

- Fiscal Responsibility: Concerns arise about the government borrowing money to purchase Bitcoin or selling underwater investments at a loss.

Global Perspectives: Other Nations Exploring Bitcoin Reserves

The concept of a strategic Bitcoin reserve is not limited to the United States. Several other countries are exploring the possibility of incorporating Bitcoin into their financial strategies.

- Switzerland: The Swiss National Bank is considering adding Bitcoin to its reserves alongside gold, aligning with Switzerland's reputation for financial innovation and independence.

- Germany: Influential voices in Germany have suggested the European Central Bank and the Bundesbank consider Bitcoin to reduce reliance on the U.S. dollar.

- Russia: Russia has begun using Bitcoin and other digital currencies for international transactions to bypass Western sanctions and reduce dependence on the U.S. dollar.

- Brazil: Brazil has introduced the sovereign strategic Bitcoin reserve, aiming to allocate some of its international reserves to Bitcoin.

- Poland: Poland is considering establishing a strategic Bitcoin reserve to diversify its financial assets and position itself as a leader in digital finance.

Potential Benefits of Bitcoin as a Strategic Asset

Despite the risks, proponents argue that Bitcoin offers several potential benefits as a strategic asset.

- Hedge Against Inflation: Bitcoin's finite supply makes it an attractive hedge against inflation and a weakening dollar.

- Economic Independence: Bitcoin adoption demonstrates a commitment to innovation and independence, challenging even authoritarian regimes to embrace its principles.

- Strategic Advantage: Early adopters of Bitcoin as a reserve asset stand to gain a strategic edge, solidifying their positions in a transforming global financial system.

The Broader Implications

The debate around strategic Bitcoin reserves has broader implications for the global monetary order and the role of digital assets in the future.

- Challenging Traditional Assets: Bitcoin is emerging as a challenger to traditional reserve assets like gold and the U.S. dollar, with the potential to reshape the global monetary order.

- Geopolitical Asset: Bitcoin is becoming a geopolitical asset, with governments and central banks around the world engaged in discussions about its role in national reserves.

- Cultural and Strategic Impact: Bitcoin symbolizes freedom and decentralization, and its adoption by nations demonstrates a commitment to innovation and independence.

Conclusion: A Financial Revolution?

The push for strategic Bitcoin reserves represents a significant development in the world of finance and geopolitics. While challenges and criticisms remain, the potential benefits of Bitcoin as a hedge against inflation, a tool for economic independence, and a strategic asset are undeniable. As more nations explore the possibility of incorporating Bitcoin into their financial strategies, the global monetary order may be on the cusp of a profound transformation. The coming years will reveal whether Bitcoin can truly fulfill its promise as "digital gold" and a cornerstone of national financial stability.

SEC Accounting Bulletins on Digital Assets: SAB 121 and SAB 122

Explore the complexities of SEC's Staff Accounting Bulletins 121 and 122, their impact on crypto custody, and the pushback from the financial industry and Congress. Learn about the ongoing debate on digital asset regulation.

Published Jan 23, 2025

Understanding the Collectibles Landscape: Baseball Cards, Stamp Paper, and the Rise of Trump Coin

Explore the world of collectibles, from baseball cards and stamp paper to the digital Trump Coin. Compare market dynamics, investment potential, and unique characteristics.

Published Jan 23, 2025

The Potential for a USA Digital Asset Stockpile: Exploring the Future of Cryptocurrency Reserves

Explore the potential of a USA digital asset stockpile, examining Trump's evolving stance, legislative initiatives, benefits, challenges, and the role of a crypto working group.

Published Jan 23, 2025