Start Investing Aligned with Values: A Comprehensive Guide

Dec 26, 2024Learn how to start investing aligned with your values through ethical, socially responsible, and impact investing. Make financial decisions that reflect your personal ethics and beliefs.

Investing is more than just growing your wealth; it's also about aligning your financial decisions with your personal values. Many people are now exploring how to start investing aligned with values? This approach, often referred to as values-based, ethical, or socially responsible investing, allows you to support causes you care about while still working toward your financial goals. This article will guide you through the process, drawing on insights from various sources to provide a comprehensive overview.

Understanding Values-Aligned Investing

Values-aligned investing is an umbrella term that encompasses several approaches, all centered on the idea of making investment choices that reflect your personal ethics and beliefs. It’s about more than just financial returns; it’s about using your money as a tool to create positive change in the world.

Socially Responsible Investing (SRI)

SRI involves actively avoiding investments in companies or industries that you believe have negative social or environmental impacts. This might mean excluding companies involved in tobacco, firearms, or fossil fuels. The goal is to prevent your money from supporting activities that conflict with your values.

Environmental, Social, and Governance (ESG) Investing

ESG investing takes a broader approach by evaluating companies based on their performance in three key areas:

- Environmental: This looks at a company's impact on the planet, including its efforts to reduce pollution, conserve resources, and promote sustainability.

- Social: This examines a company's relationships with its employees, customers, and the broader community, focusing on factors like labor practices, diversity, and human rights.

- Governance: This assesses a company's leadership, transparency, and ethical business practices.

ESG criteria can be used to either exclude companies that perform poorly or to actively seek out companies that are leaders in ESG practices.

Impact Investing

Impact investing goes a step further by intentionally directing capital toward projects and companies that are designed to create a positive social or environmental impact, in addition to financial returns. This might include investing in renewable energy, affordable housing, or businesses that promote gender equality. Impact investors actively seek out opportunities to make a difference with their money.

Credit: usbank.com

Credit: usbank.com

Identifying Your Core Values

Before you can start investing aligned with values?, it’s essential to identify your core principles. What do you care about most deeply? What kind of world do you want to help create? Some common values that people consider when making investment decisions include:

- Environmental sustainability

- Social justice and equality

- Ethical corporate practices

- Community development

- Religious or spiritual principles

- Healthcare and disease prevention

- Education and literacy

Take some time for self-reflection. What qualities do you strive to bring to every situation? What do you want to be known for? What causes matter to you? Your answers to these questions will form the foundation of your values-aligned investment strategy.

Aligning Your Spending, Saving, and Investing

Once you have a clear sense of your values, you can start to align your financial decisions with them. This involves evaluating your spending, saving, and investing habits.

Intentional Spending

Conscious spending means making purchasing decisions that reflect your values. Research the companies you support to see if they align with your beliefs. If you value sustainability, for example, you might choose to buy from companies that use eco-friendly practices and materials. If you value ethical labor, you might choose to support companies that treat their employees fairly.

Values-Based Saving

Consider where you keep your savings. Do the banks or credit unions align with your values? Many financial institutions have mission statements that indicate their priorities. You can also research whether they have been involved in any scandals or controversies. If your current institution doesn't align with your values, you may want to move your money to a local credit union or online bank that better reflects your principles.

Values-Aligned Investing

Investing in line with your values involves selecting investments that support the causes and beliefs that are important to you. Here are some ways to approach this:

- Community Investments: Invest directly in your community by supporting local businesses, real estate, or non-profits. This keeps your money circulating locally and contributes to the economic health of your area.

- Start-Ups: Consider investing in small companies that align with your values through crowdfunding platforms. This allows you to support innovative projects and businesses that are making a positive impact.

- Value-Based or Socially Responsible Investments: Look for larger companies that adhere to the same values as you. Many brokerage firms now offer tools that allow you to screen companies based on ESG criteria, or you can invest in mutual funds that focus on socially responsible companies.

- ESG Funds: Choose funds that prioritize companies with strong environmental, social, and governance practices. These funds can help you align your investments with your values while still maintaining a diversified portfolio.

It's important to remember that risk and return are related. Be careful not to give ESG exposures too much credit (or blame) for ESG strategies’ returns. Consulting with experts who have the proper research capabilities and manager due diligence will help you identify the solutions that offer the best potential for performance after accounting for fees.

How to Start Investing Aligned with Values?

Now that you understand the principles and approaches, here are the steps you can take to start investing aligned with values?:

- Define Your Values: Start by making a list of three to five values or priorities that will guide your financial decisions. Be as specific as possible.

- Evaluate Your Current Investments: Take a close look at your current portfolio. Do you know where your money is going? Do the companies you are invested in align with your values?

- Research Your Options: Explore various investment options, including community investments, start-ups, and socially responsible funds. Look into the companies and projects you are considering to ensure they meet your standards.

- Set Your Goals: Determine what you want to achieve with your investments. Are you primarily focused on financial returns, or are you willing to prioritize impact over profit?

- Choose Your Investments: Select investments that align with your values and goals. Consider diversifying your portfolio to reduce risk.

- Monitor Your Progress: Regularly review your investments to ensure they continue to align with your values. Be prepared to make adjustments as needed.

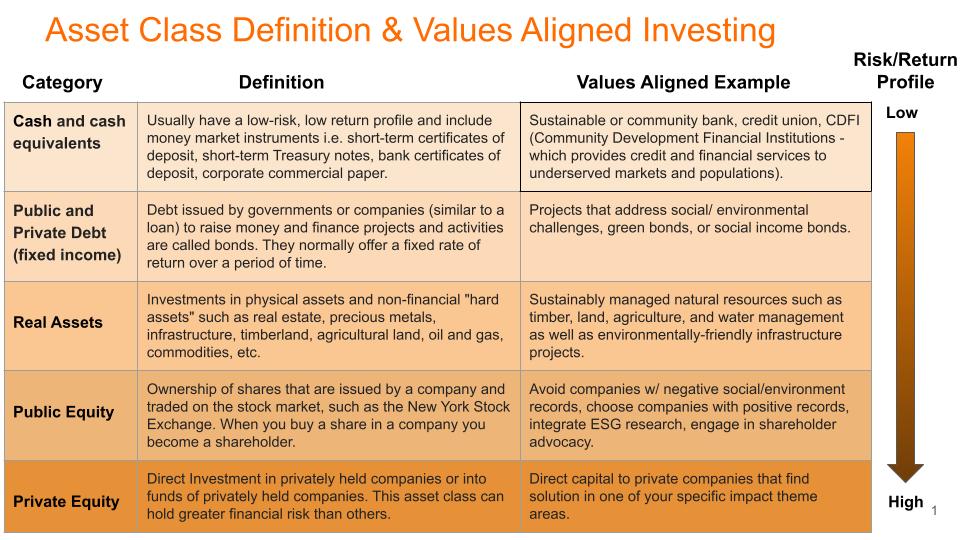

Credit: ncfp.org

Credit: ncfp.org

Finding the Right Advisor

If you're feeling overwhelmed by the process of values-aligned investing, consider seeking the help of a financial advisor who specializes in this area. Look for an advisor who:

- Has experience with values-aligned investing.

- Understands your values and goals.

- Can provide specific examples of impact investment options.

- Can help you engage in shareholder advocacy.

ValuesAdvisor is a nonprofit resource that offers a database of financial advisors who specialize in values-aligned investing. They can help you find the right advisor for your specific needs.

Overcoming Challenges

While values-aligned investing offers many benefits, it’s important to be aware of the potential challenges:

- Limited Options: Depending on your specific values, you may have fewer investment choices. This may require more research to find options that align with your values.

- Performance Myths: Some people worry that values-based investments may underperform traditional investments, but many studies show that this is not necessarily the case.

- Complexity: Evaluating values-aligned investments can be more complex than traditional investing. You may need to do more research and analysis.

- Lack of Standardization: Measuring and reporting ESG performance is not always standardized, making comparisons challenging.

Despite these challenges, it's important to remember that you don't have to sacrifice financial returns to invest in alignment with your values. There are many ways to build a diversified portfolio that reflects both your financial goals and your personal ethics.

The Benefits of Values-Aligned Investing

When you start investing aligned with values?, you're not just growing your wealth; you’re also:

- Supporting Causes You Care About: You can use your money to make a positive impact on the issues that are important to you.

- Feeling Good About Your Choices: Knowing that your investments are aligned with your values can give you a greater sense of purpose and satisfaction.

- Managing Risk: Companies with strong ESG practices often manage risks better, potentially leading to more stable returns.

- Improving Family Harmony: For families, aligning sustainable-investing goals can bring different generations together around a shared vision and purpose.

- Building a Better World: You can contribute to positive social and environmental change.

Conclusion

Aligning your investments with your values is a powerful way to use your money for good. It’s about making conscious choices that reflect your personal ethics and beliefs, while still working towards your financial goals. By taking the time to identify your values, research your options, and make intentional decisions, you can start investing aligned with values? and create a financial strategy that truly reflects who you are and what you care about most.

SEC Accounting Bulletins on Digital Assets: SAB 121 and SAB 122

Explore the complexities of SEC's Staff Accounting Bulletins 121 and 122, their impact on crypto custody, and the pushback from the financial industry and Congress. Learn about the ongoing debate on digital asset regulation.

Published Jan 23, 2025

Understanding the Collectibles Landscape: Baseball Cards, Stamp Paper, and the Rise of Trump Coin

Explore the world of collectibles, from baseball cards and stamp paper to the digital Trump Coin. Compare market dynamics, investment potential, and unique characteristics.

Published Jan 23, 2025

The Potential for a USA Digital Asset Stockpile: Exploring the Future of Cryptocurrency Reserves

Explore the potential of a USA digital asset stockpile, examining Trump's evolving stance, legislative initiatives, benefits, challenges, and the role of a crypto working group.

Published Jan 23, 2025