Stock Market Crash on December 19, 2024: What Should Investors Expect?

Dec 19, 2024Learn about the December 19, 2024 stock market downturn, its causes, expert predictions, and strategies for investors navigating market volatility, including tips on buying undervalued assets and managing risks.

Stock Market Crash on December 19, 2024: What Should Investors Expect

The recent market downturn has left many investors wondering about the possibility of a stock market crash. News sources offer varying perspectives and advice. Let's examine the available information:

Market Volatility and Recent Events

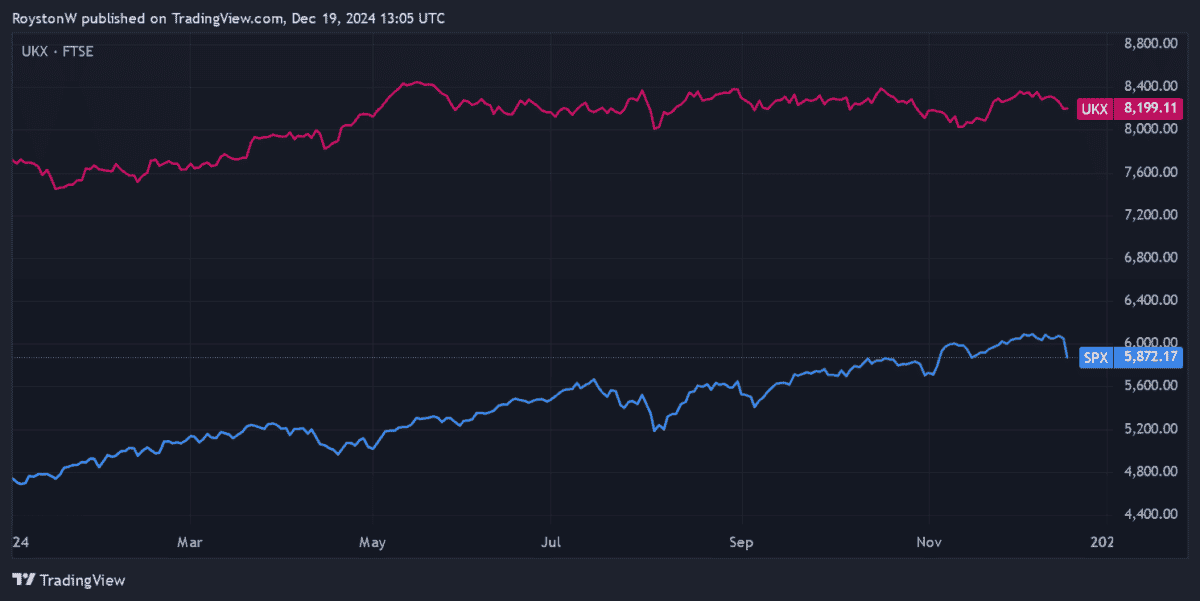

Several sources report significant market drops on December 18th, 2024. Finbold highlights a $1.5 trillion wipeout from the stock market, with the S&P 500 and Russell 2000 indices erasing post-election gains. The article attributes this to the Federal Reserve's (Fed) meeting, where, despite a rate cut, the Fed cautioned about fewer cuts than anticipated in 2025 and revised its inflation outlook upward. This led to concerns about persistent inflation and potentially higher interest rates for longer than initially hoped.

The New York Times also covers the Fed's rate cut and subsequent market plunge. The article emphasizes that while the Fed cut rates, it lowered expectations for future cuts in 2025, leading to a significant drop in stock prices. The S&P 500 experienced its biggest fall since early September, and the Russell 2000 its worst one-day performance in over two and a half years.

Analyst Opinions and Predictions

While some analysts express concerns about overvalued stocks and potential further falls, others remain less certain about an imminent crash. The Motley Fool UK article presents a balanced view, acknowledging the market's volatility but emphasizing that market turbulence is common and long-term returns from share investing remain impressive. The author outlines their strategy of seeking beaten-down shares and continues to hold their investments.

Investor Actions and Strategies

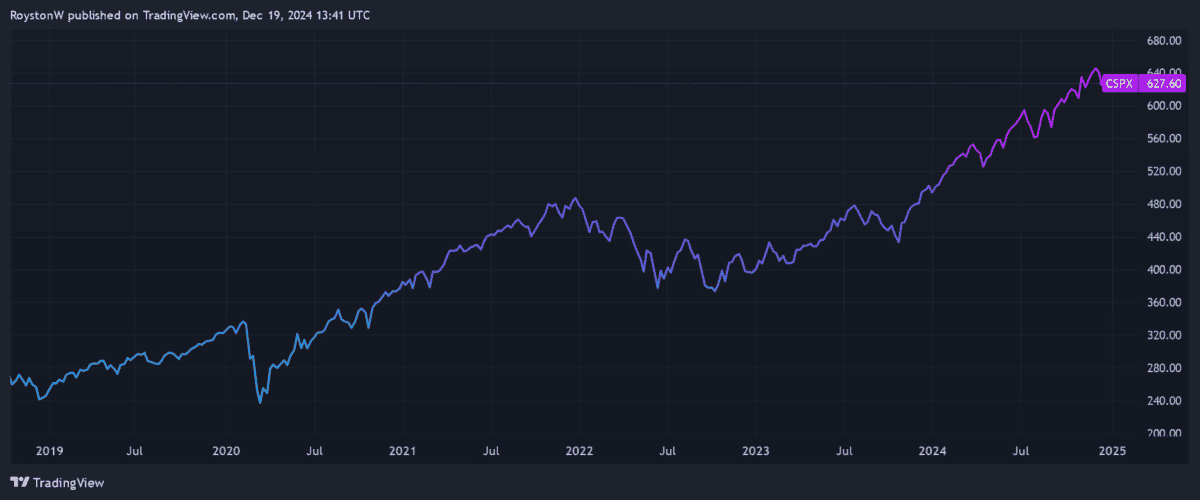

The Motley Fool UK article suggests that rather than reducing holdings, investors should look for opportunities to buy undervalued assets. The author mentions the iShares S&P 500 ETF (LSE:CSPX) as a potential investment, highlighting its diversification and growth potential.

Reuters reports that despite the recent rally, demand for options protection against a market crash is increasing, suggesting investor caution. The Motley Fool, in a separate article, acknowledges the possibility of market corrections or crashes but advises against completely avoiding stocks.

Conclusion

The information suggests significant market volatility and uncertainty. While a crash is not definitively predicted, the possibility exists. Investor strategies vary, with some focusing on identifying undervalued assets and maintaining long-term investment horizons, while others seek protective measures. The situation warrants careful monitoring and a well-defined investment strategy tailored to individual risk tolerance and financial goals. It's crucial to consult with a financial advisor for personalized guidance.

SEC Accounting Bulletins on Digital Assets: SAB 121 and SAB 122

Explore the complexities of SEC's Staff Accounting Bulletins 121 and 122, their impact on crypto custody, and the pushback from the financial industry and Congress. Learn about the ongoing debate on digital asset regulation.

Published Jan 23, 2025

Understanding the Collectibles Landscape: Baseball Cards, Stamp Paper, and the Rise of Trump Coin

Explore the world of collectibles, from baseball cards and stamp paper to the digital Trump Coin. Compare market dynamics, investment potential, and unique characteristics.

Published Jan 23, 2025

The Potential for a USA Digital Asset Stockpile: Exploring the Future of Cryptocurrency Reserves

Explore the potential of a USA digital asset stockpile, examining Trump's evolving stance, legislative initiatives, benefits, challenges, and the role of a crypto working group.

Published Jan 23, 2025