US ETFs Hit $1 Trillion in 2024: A Record-Breaking Year

Jan 4, 2025The year 2024 was a record-breaking year for US ETFs, hitting $1 trillion in assets due to massive inflows. Equity and fixed income ETFs led the charge, with innovative products like crypto ETFs also contributing to the surge.

The year 2024 marked an extraordinary period for the exchange-traded fund (ETF) industry, witnessing unprecedented inflows that shattered previous records. Investors poured capital into these versatile investment vehicles, propelling the industry to new heights. This surge in popularity has not only established new benchmarks but also fueled optimism for the future of ETFs in 2025 and beyond. The remarkable milestone of US ETFs hitting $1 trillion in 2024 is a testament to their growing appeal and the confidence investors have in their potential.

Record-Breaking Inflows Define 2024 for US ETFs

The US ETF market experienced a phenomenal year, with inflows reaching a staggering $1.1 trillion, officially setting a new annual record. This milestone signifies a major shift in investor preferences, as ETFs continue to attract significant capital from both retail and institutional investors. The sheer volume of inflows underscores the growing acceptance of ETFs as a preferred investment vehicle.

The Journey to $1 Trillion and Beyond

The journey to this record-breaking inflow was marked by several key milestones. By November 11th, 2024, US-listed ETFs had already accumulated $897 billion, surpassing the 2021 record of $911 billion. The subsequent weeks saw a continued influx, with over $84 billion in net inflows in November alone, and a total of $205 billion in the fourth quarter. This consistent growth pushed the industry past the $1 trillion mark, showcasing the strong momentum behind ETF investments. The fact that US ETFs hit $1 trillion in 2024 demonstrates a fundamental shift in how investors are allocating their capital.

Drivers Behind the ETF Inflow Surge

Several factors contributed to the unprecedented ETF inflows in 2024. These include strong performance in equity markets, the rise of new ETF products, and the inherent benefits of ETFs, like diversification, tax efficiency, and cost effectiveness.

Equity ETFs Lead the Charge

Equity ETFs, particularly those tracking the S&P 500, experienced significant demand. The Vanguard S&P 500 ETF (VOO), iShares Core S&P 500 ETF (IVV), and SPDR S&P 500 ETF (SPY) were among the most popular, attracting substantial inflows as the US stock market climbed to new highs. VOO and IVV even broke their calendar year record for individual ETF net inflows. Furthermore, the iShares Russell 2000 ETF (IWM) saw a turnaround in inflows after the re-election of President Trump, as investors anticipated benefits for smaller companies. Overall, equity ETFs accounted for 65% of the industry's total cash haul, highlighting their dominance in the market.

Fixed Income ETFs Gain Traction

Beyond equities, fixed income ETFs also experienced a record year, pulling in more than $270 billion in net inflows. This surge surpassed the inflows seen in 2020 and 2021, showcasing a growing interest in bond ETFs as a means to manage risk and generate income. Core bond ETFs like iShares Core Aggregate Bond ETF (AGG) and Vanguard Total Bond Index ETF (BND) were particularly popular, along with those focused on interest rate risk, such as the iShares 20+ Year Treasury Bond ETF (TLT) and the iShares 0-3 Month Treasury Bond ETF (SGOV). This diversification across asset classes demonstrates the adaptability and appeal of ETFs.

The Rise of Innovative ETFs

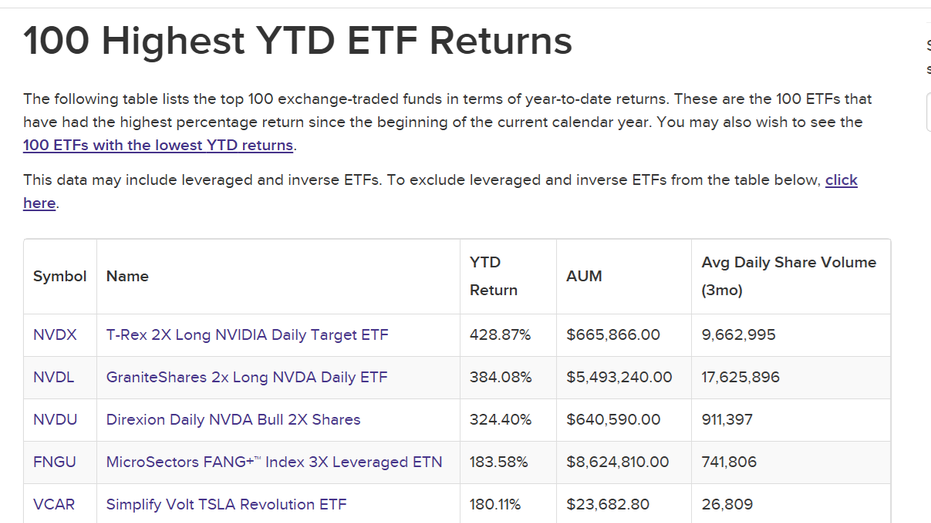

The ETF landscape has continued to evolve, with new and innovative products gaining traction. Cryptocurrency ETFs, such as the iShares Bitcoin Trust ETF (IBIT), and single-stock ETFs, like the GraniteShares 2X Long NVIDIA Daily ETF (NVDL), have broadened the investor base by catering to those with a higher risk appetite. This expansion of ETF offerings has enabled investors to access a wider range of investment opportunities. The fact that US ETFs hit $1 trillion in 2024 was, in part, fueled by this innovation.

Credit: a57.foxnews.com

Credit: a57.foxnews.com

Analyzing the Top Performing ETFs

While broad market ETFs saw considerable inflows, several individual ETFs achieved significant milestones, reflecting diverse investment strategies and market trends.

S&P 500 ETFs Lead in Inflows

The Vanguard S&P 500 ETF (VOO) stands out as a major winner, securing over $122 billion in inflows, far outpacing its competitor SPDR S&P 500 ETF (SPY). The iShares Core S&P 500 ETF (IVV) also saw strong inflows, further solidifying the appeal of broad market exposure through ETFs. The competition between SPY and VOO highlights the importance of expense ratios, with VOO's lower ratio making it a more attractive option for many investors.

Notable Individual ETF Successes

Beyond the S&P 500 giants, other ETFs crossed significant thresholds. The American Century US Quality Growth ETF (QGRO), the Eaton Vance Floating-Rate ETF (EVLN), and the NEOS S&P 500 High Income ETF (SPYI) all surpassed the $1 billion or $2 billion mark in assets under management, showcasing the growing success of newer entrants in the ETF market. These achievements emphasize the increasing diversity and sophistication of the ETF landscape.

Active ETFs Gain Momentum

Active ETFs also saw increased interest, with record inflows into both active equity and active fixed income strategies. This growing acceptance of active management within the ETF structure indicates that investors are increasingly seeking alpha-generating strategies while enjoying the benefits of the ETF wrapper. The fact that US ETFs hit $1 trillion in 2024 is a result of both passive and active strategies gaining popularity.

The Broader Implications of ETF Growth

The record-breaking inflows into US ETFs reflect not only a growing preference for these investment vehicles but also a broader shift in investor behavior and market dynamics.

ETFs as a Mainstream Investment Tool

ETFs are becoming increasingly mainstream, attracting capital from a wide range of investors, including retail, institutional, and even cash-strapped mutual funds. Their liquidity, tax efficiency, and cost advantages make them a viable alternative to traditional investment options. The growth of the ETF market has also fueled innovation, with new and specialized products constantly emerging to cater to evolving investor needs.

Impact on Market Dynamics

The significant inflows into ETFs have a profound impact on market dynamics, particularly in driving price discovery and liquidity. The concentration of flows in specific sectors and strategies can also influence market trends, highlighting the importance of understanding the underlying drivers of ETF demand. The fact that US ETFs hit $1 trillion in 2024 means ETFs are now a major force in the financial market.

The Future of ETFs

The milestone of US ETFs hitting $1 trillion in 2024 sets the stage for continued growth and evolution in the ETF market. With new products and strategies constantly being developed, ETFs are poised to play an even greater role in shaping investment landscapes in the coming years. As investors increasingly seek diversified, cost-effective, and flexible investment solutions, ETFs are well-positioned to meet these demands, further solidifying their place as a cornerstone of modern investment strategies.

Optimism for 2025 and Beyond

The ETF market's record-breaking performance in 2024 has fueled optimism for 2025 and beyond. The continued growth of both passive and active ETFs, along with the emergence of innovative new products, suggests that the industry is poised for further expansion.

Continued Innovation and Growth

The success of ETFs in 2024 is expected to spur further innovation and growth in the ETF market. The introduction of new asset classes, strategies, and investment approaches will continue to broaden the appeal of ETFs and attract new investors. As the market evolves, ETFs are likely to play an even greater role in shaping the future of investing.

The Potential for Continued Inflows

The trends observed in 2024 suggest that the strong demand for ETFs is likely to continue in 2025. The market's resilience, coupled with the growing popularity of ETFs as a core investment tool, points towards further inflows and expansion of the industry. This suggests that the milestone of US ETFs hitting $1 trillion in 2024 is not a peak, but rather a foundation for further success.

In conclusion, the milestone of US ETFs hitting $1 trillion in 2024 is a significant achievement, highlighting the growing importance of these versatile investment vehicles in the modern financial landscape. The record-breaking inflows, coupled with the innovation and diversification within the ETF market, indicate a promising future for ETFs and their role in helping investors achieve their financial goals.

SEC Accounting Bulletins on Digital Assets: SAB 121 and SAB 122

Explore the complexities of SEC's Staff Accounting Bulletins 121 and 122, their impact on crypto custody, and the pushback from the financial industry and Congress. Learn about the ongoing debate on digital asset regulation.

Published Jan 23, 2025

Understanding the Collectibles Landscape: Baseball Cards, Stamp Paper, and the Rise of Trump Coin

Explore the world of collectibles, from baseball cards and stamp paper to the digital Trump Coin. Compare market dynamics, investment potential, and unique characteristics.

Published Jan 23, 2025

The Potential for a USA Digital Asset Stockpile: Exploring the Future of Cryptocurrency Reserves

Explore the potential of a USA digital asset stockpile, examining Trump's evolving stance, legislative initiatives, benefits, challenges, and the role of a crypto working group.

Published Jan 23, 2025